Position: former head of the State Tax Service.

Sphere of corruption: financial.

Region of corruption activity: all of Ukraine.

Qualification: the actions are qualified under Part 1 of Article 255, Part 2 of Article 255, Part 3 of Article 212, Part 2 of Article 364, Part 4 of Article 368, Part 3 of Article 369 of the Criminal Code of Ukraine.

Status: At large, because he was released on bail.

Case story: In late October 2025, the SAPO and NABU, together with the Security Service of Ukraine, exposed a conversion center with a turnover of UAH 15 billion, in whose activities the former leadership of the State Tax Service was involved. Suspicions were announced against 11 participants in the criminal scheme, and the head of the center was detained while trying to leave Ukraine.

According to law enforcement officials, the conversion center was run with the participation of the former head of the State Tax Service and the former deputy head of the Main Department of the State Tax Service in the Poltava region. According to media reports, these are Yevgeny Oleinnikov and Natalia Novozhenina.

As the investigation established, the former head of the State Tax Service in 2021 contributed to the smooth operation of the conversion center, and his former deputy, who headed the commission on suspension of registration of tax invoices, ensured that decisions were made in favor of the necessary companies.

The investigation found that the organization's members created a scheme of over 200 legal entities to minimize tax payments. The center's activities were made possible through systematic abuse of State Tax Service officials and bribery of individual employees.

According to the case materials, in 2020–2023, the center issued tax invoices with false data for a total of UAH 15 billion, and fictitious VAT amounted to over UAH 2.3 billion. As a result of the transaction, the state budget received more than UAH 147 million less.

Remote servers abroad, VPN services to mask IP addresses, foreign SIM cards, and fake officials were used to conceal criminal activity.

So far, 11 participants in the scheme have been suspected, and the head of the conversion center was detained while attempting to leave Ukraine.

Subsequently, the HIgh Anti-Corruption Court set bail of over UAH 5 million for the former head of the State Tax Service, Yevhen Oleinnikov.

This decision was made by the investigating judge of the Supreme Court of Justice on October 27, which was left unchanged by the Supreme Court of Justice Appeals Chamber on November 13.

As noted, on October 27, the court set a bail of UAH 5,014,368 with the obligation to perform duties for Oleinikow without wearing a bracelet, but with the obligation to surrender his passport. The court also set a bail of UAH 3,028,000 for the former deputy head of the Main Department of the State Tax Service in Poltava region, Natalia Novozhenina, with duties, but without a bracelet.

On October 30, the court arrested Tetyana Yefimova and set her a 20 million UAH bail. NABU and SAPO suspect her of committing criminal offenses under Part 1 of Art. 255, Part 5 of Art. 27, Part 3 of Art. 212 of the Criminal Code of Ukraine. According to the investigation, she was the chief accountant of the conversion center. Her defense attorney filed an appeal against this decision.

The appeal of the suspect's (Efimova - ed.) defense lawyer is to be dismissed, and the ruling of the investigating judge of the High Anti-Corruption Court of October 30, 2025 is to be left unchanged.

The court also set a bail of over UAH 4 million for the head of one of the private companies, Yevhen Kazachenko. He was also given a number of obligations, including surrendering his international passports, not leaving his place of residence, and others. A bail of UAH 242,240 was set for Alena Drozdyk, an employee of the currency exchange center. She also has similar obligations.

In addition, the court took Vadym Bogomol into custody, who, according to the investigation, is the organizer of the conversion center. As an alternative, a bail of UAH 19 million was set for him.

Persons potentially involved in corruption schemes: former deputy head of the Main Department of the State Tax Service in Poltava region Natalia Novozhenina, as well as 10 other participants in the scheme (in particular, employees of the "envelope center" and representatives of private companies).

Assets: In his 2021 tax declaration, Oleinikow indicated that he owns an apartment in Kyiv in joint ownership with his son. At the same time, his wife Lyudmila declared an apartment in Kyiv and six plots of land in the Kyiv region.

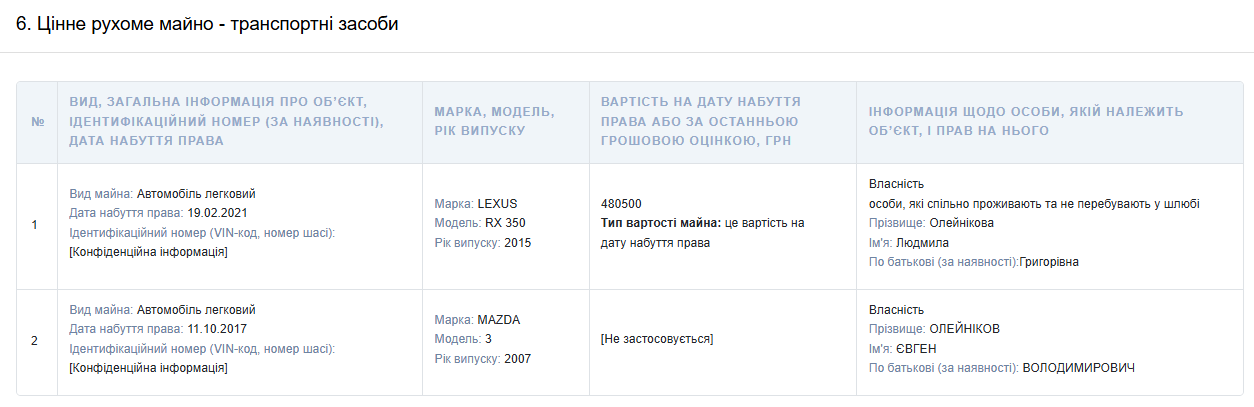

Oleinnikov also declared a car - a Mazda 3, and his wife - a Lexus RX350 (worth 480,500 UAH).

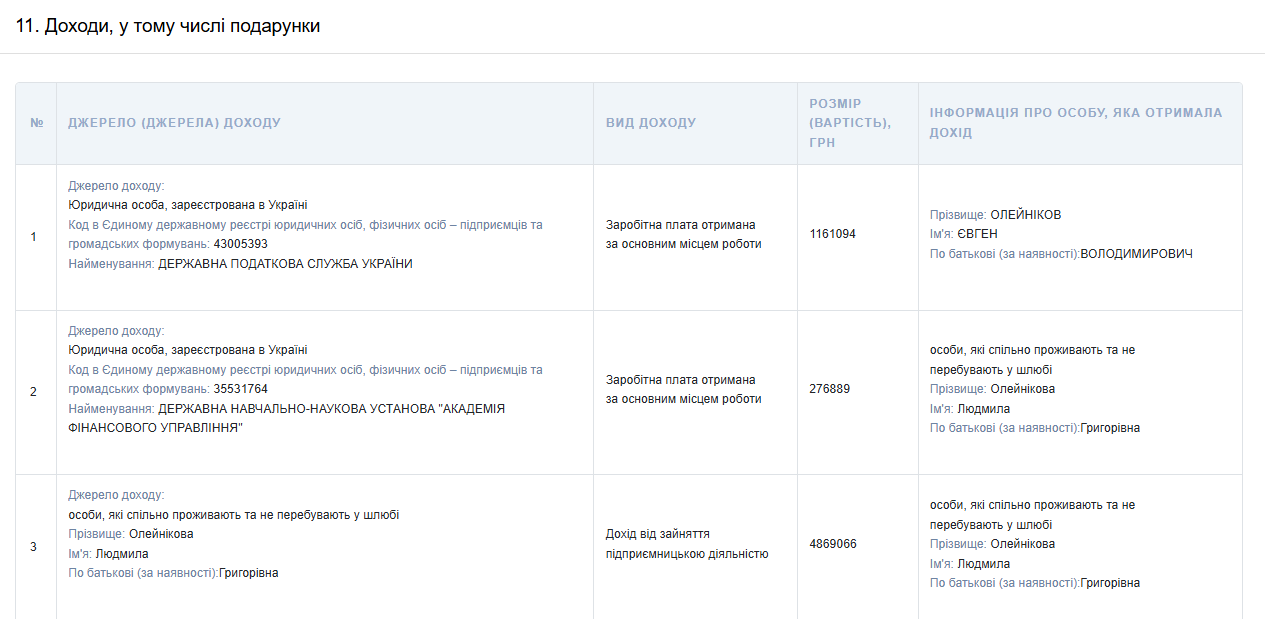

Oleinnikov's income for this year was UAH 1,161,094, and his wife's was UAH 5,405,955.

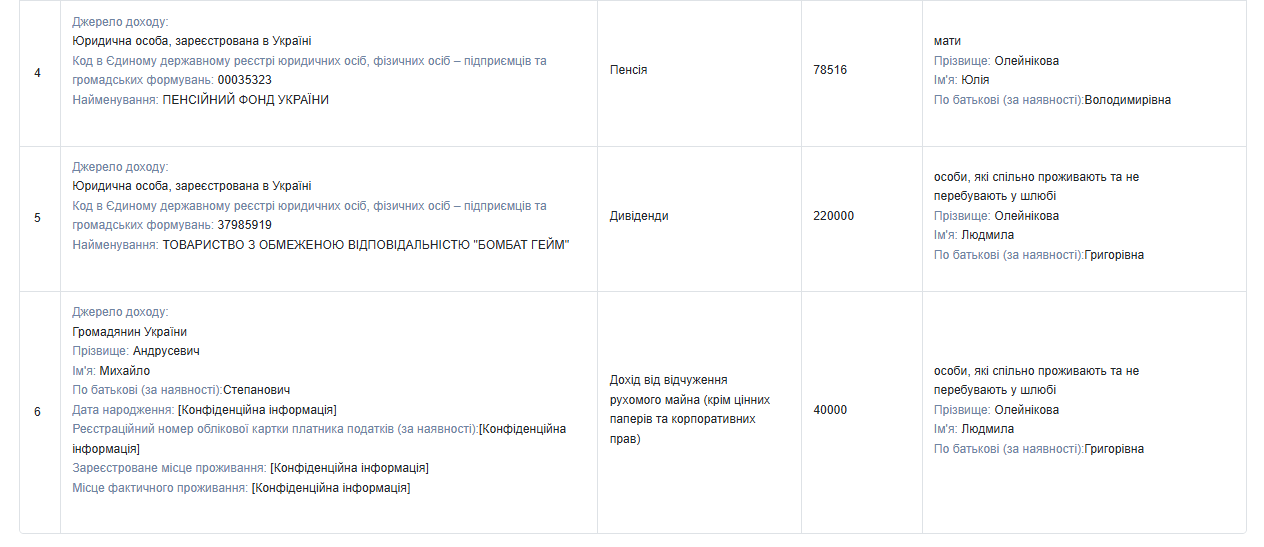

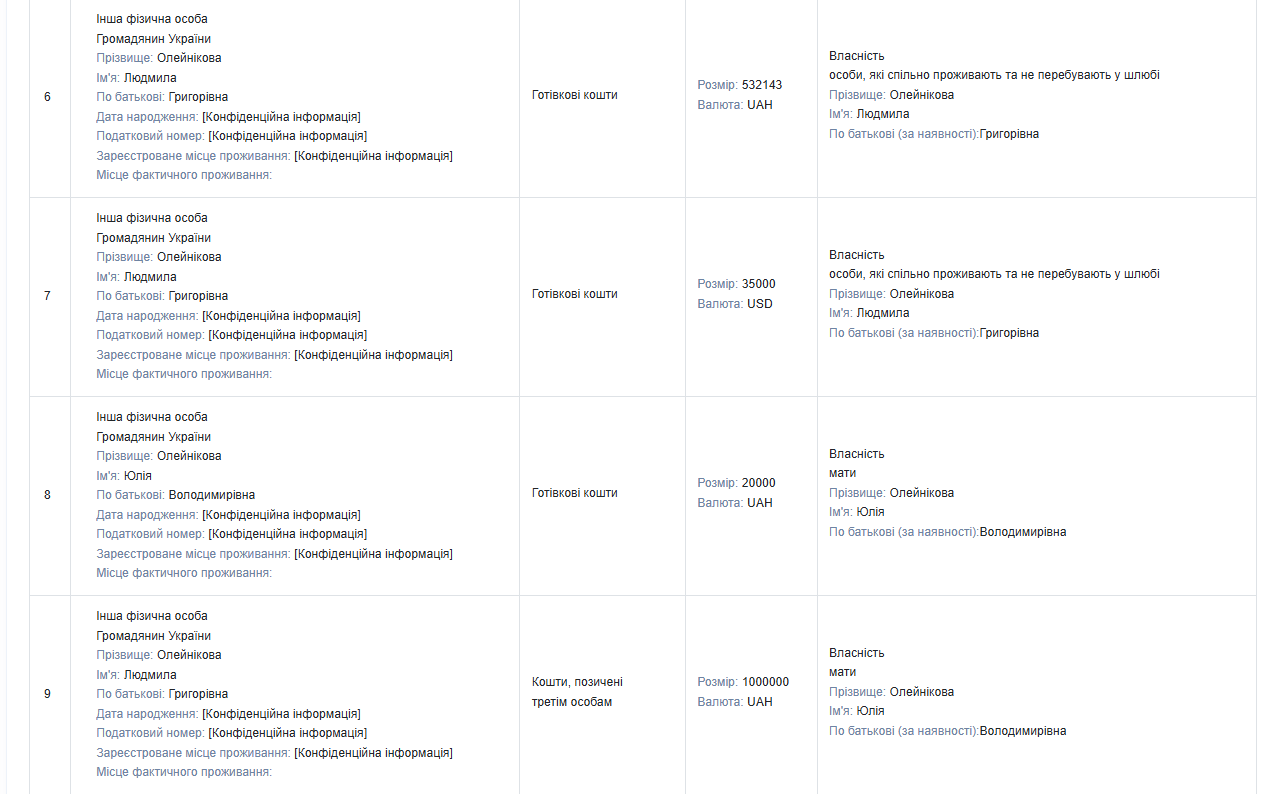

The former official declared 112,000 UAH and 10,000 USD in cash. His wife Lyudmila declared 532,143 UAH and 35,000 USD in cash, and her bank accounts contained 608,897 UAH and 13,705 USD. In addition, Oleinnikov and his wife lent the ex-official's mother a total of 1,500,000 UAH.

Persons who should have reacted: law enforcement agencies responded to the criminal activity in a timely manner, handing each participant in the scheme a suspicion.

Scandals: Back in November 2021, law enforcement officers searched the residence of Oleinikow and his mother. As Oleinikow himself explained, the searches were related to the fact that, according to NABU, he may be involved in covering up the illegal activities of a certain group of enterprises.

The NABU, in turn, reported that searches were conducted in the premises of the central office of the State Tax Service, the State Tax Service in Poltava region, at the residences of tax service officials and a number of individuals in Kyiv, as well as in Poltava, Dnipropetrovsk and Zaporizhia regions.

The State Tax Service clarified that in December 2020 and January 2021, it conducted its own inspection of the Main Department of the State Tax Service in Poltava region on the issues of working out risky companies, in particular, regarding the enterprises that appear in this criminal case. According to the results of the inspection, violations were identified by representatives of the Main Department of the State Tax Service in Poltava region, in connection with which disciplinary measures were taken against officials. Regarding the circumstances identified during the said inspection and which could have signs of criminal violations, the State Tax Service transferred information to the State Bureau of Investigation.

Sources:

https://public.nazk.gov.ua/documents/f5707d1f-1b67-4472-8043-a7d55acaed3f